Detached house prices continued to rebound in most Fraser Valley markets. 📊 Tyler Olsen

Home prices have slumped across the valley as for-sale signs become increasingly common.

Last month, prospective home buyers could choose from more than 4,000 homes listed for sale between Langley and Chilliwack. Despite all that supply, relatively few people are buying. Although the number of sales edged upwards, 15% fewer homes traded hands than a year ago.

These charts use data from local real estate boards. Data for Langley, Abbotsford, and Mission comes from the Fraser Valley Real Estate Board. You can find it here. Data for Chilliwack comes from the Chilliwack and District Real Estate Board. You can find it here.

If you find an error in the data, please let us know by emailing us.

Fraser Valley home prices

Why are we using a rolling average?

The following charts show the month-over-month change in a three-month rolling average for a trio of home price measures. (The rolling average is the average of the last three months.) The use of a rolling average allows for larger sample sizes and removes statistical noise caused monthly spikes and dips that obscure broader trends.

How to read the charts:

The charts show the rolling average’s change from the preceding month. If a line is in the red-coloured area, it means the rolling average value has decreased from the last month. If the line is in the white, it means the rolling average has increased. Note that the Y axis may change from graph to graph.

The black line represents the ‘benchmark price,’ which is a value calculated by real estate boards that tries to capture the cost of a ‘typical’ home in a community. The median price (light blue) and average price (grey) are based on sales from the previous month. Those indicators can vary considerably depending on whether a large proportion of homes sold are particularly expensive (or cheap). The median and average prices can—but do not always—influence the future direction of the benchmark price.

Langley

After declining in the latter half of 2024, detached home and apartment prices in Langley had risen slowly through the start of 2025. But May saw a relatively sudden downturn of benchmark house price in both property classes. Benchmark prices are only slightly lower than they were at this time last year, but median and average sale prices across all classes have started to drop, suggesting buyers are seeking cheaper homes.

Raw data: Benchmark prices

Month | Detached | Townhome | Apartment |

|---|---|---|---|

Jun 24 | $1,637,500 | $872,600 | $618,100 |

Jul 24 | $1,635,100 | $878,900 | $618,300 |

Aug 24 | $1,647,300 | $884,700 | $611,600 |

Sep 24 | $1,633,700 | $873,100 | $606,500 |

Oct 24 | $1,613,500 | $864,800 | $604,800 |

Nov 24 | $1,618,400 | $867,200 | $601,000 |

Dec 24 | $1,606,500 | $862,800 | $599,900 |

Jan 25 | $1,616,600 | $864,600 | $603,900 |

Feb 25 | $1,626,900 | $868,000 | $607,700 |

Mar 25 | $1,635,200 | $865,100 | $611,900 |

Apr 25 | $1,650,700 | $861,800 | $611,200 |

May 25 | $1,632,100 | $863,600 | $605,300 |

Abbotsford

In Abbotsford, single-family home prices continue to bounce around, but the townhome and apartment markets have been relatively strong—especially compared to neighbouring communities. The average and median sales prices for townhomes and apartments ticked upwards in the last month, suggesting some resilience in the market.

Raw data: Benchmark prices

Month | Detached | Townhome | Apartment |

|---|---|---|---|

Jun 24 | $1,227,400 | $666,800 | $446,900 |

Jul 24 | $1,234,700 | $666,700 | $448,200 |

Aug 24 | $1,222,000 | $664,500 | $443,100 |

Sep 24 | $1,200,700 | $657,500 | $433,600 |

Oct 24 | $1,195,900 | $649,000 | $446,700 |

Nov 24 | $1,193,000 | $651,000 | $438,400 |

Dec 24 | $1,195,200 | $654,500 | $436,300 |

Jan 25 | $1,207,400 | $653,700 | $440,900 |

Feb 25 | $1,215,200 | $654,500 | $448,000 |

Mar 25 | $1,225,500 | $656,100 | $443,700 |

Apr 25 | $1,211,600 | $655,700 | $438,000 |

May 25 | $1,202,700 | $660,600 | $435,000 |

Mission

Mission continues to see limited demand for the hundreds of homes listed for sale. The FVREB’s benchmark price for detached homes in the city plunged by more than $40,000 in May. That partially reflects sales figures from the previous month, but after a strong 2024, buyers appear less enthusiastic about the north Fraser community.

Raw data: Benchmark prices

Month | Detached | Townhome | Apartment |

|---|---|---|---|

Jun 24 | $1,056,300 | $675,400 | $456,600 |

Jul 24 | $1,048,900 | $685,700 | $466,700 |

Aug 24 | $1,045,900 | $684,400 | $462,000 |

Sep 24 | $1,003,400 | $672,000 | $462,800 |

Oct 24 | $1,017,100 | $675,200 | $459,800 |

Nov 24 | $1,026,100 | $678,300 | $463,300 |

Dec 24 | $1,023,000 | $682,700 | $457,900 |

Jan 25 | $1,025,000 | $685,500 | $457,400 |

Feb 25 | $1,066,600 | $664,700 | $458,700 |

Mar 25 | $1,064,400 | $668,500 | $455,800 |

Apr 25 | $1,062,100 | $662,200 | $448,300 |

May 25 | $1,019,100 | $676,100 | $453,000 |

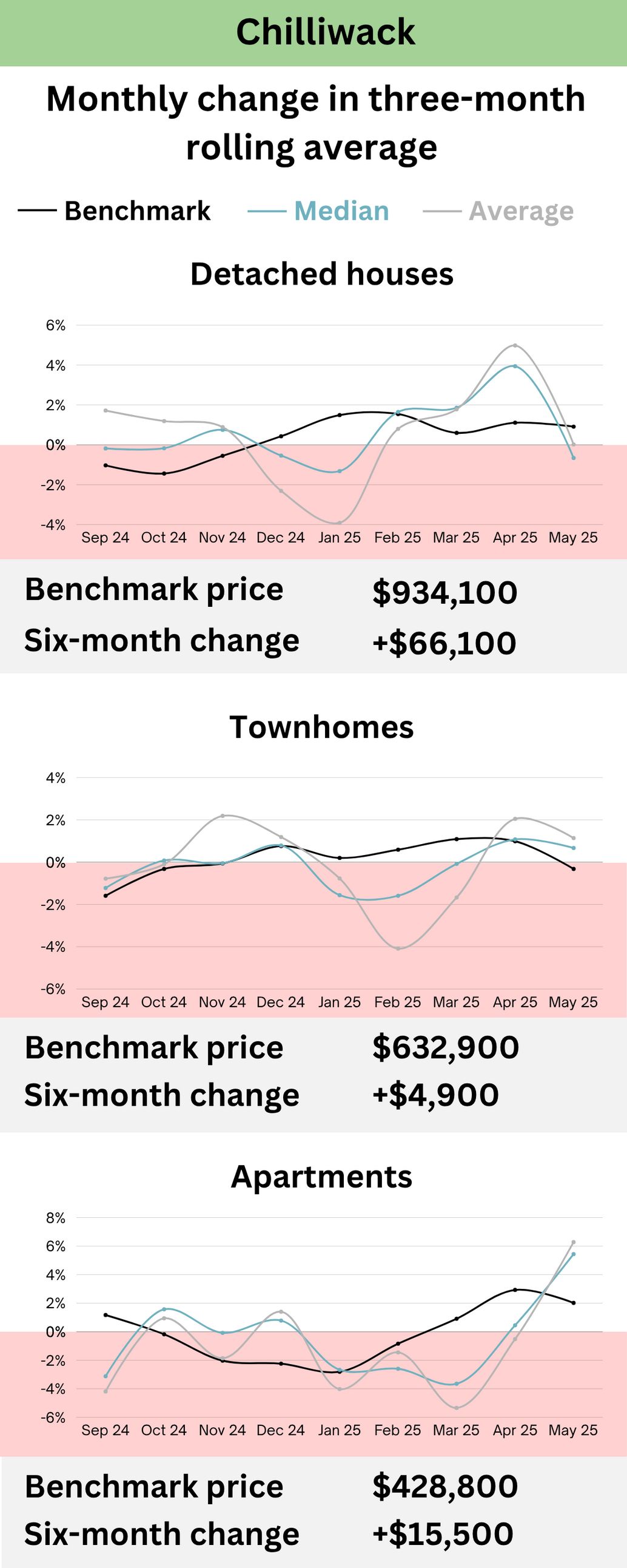

Chilliwack

Detached home prices have started to dip even in Chilliwack, which has had the region’s strongest single-family housing market over the past year.

Prices remain higher than they were a year ago, but May brought declines in the average and median sales prices of detached houses, although the city’s apartment market was comparatively strong. The prices reflect the increasing options for those looking to buy—especially those seeking family-sized homes. As of May, there were about 1,100 detached homes and townhouses listed for sale. Despite all that supply, there were nearly 45% fewer sales recorded in May than the same month last year.

Raw data: Benchmark prices

Month | Detached | Townhome | Apartment |

|---|---|---|---|

Jun 24 | $909,700 | $642,600 | $418,500 |

Jul 24 | $905,600 | $628,900 | $426,800 |

Aug 24 | $882,500 | $629,200 | $440,100 |

Sep 24 | $881,800 | $612,400 | $433,600 |

Oct 24 | $867,100 | $622,900 | $424,500 |

Nov 24 | $868,000 | $628,000 | $413,800 |

Dec 24 | $893,100 | $626,500 | $405,100 |

Jan 25 | $906,200 | $626,700 | $389,600 |

Feb 25 | $909,100 | $639,100 | $403,700 |

Mar 25 | $909,300 | $647,200 | $416,000 |

Apr 25 | $936,400 | $645,600 | $425,000 |

May 25 | $934,100 | $632,900 | $428,800 |

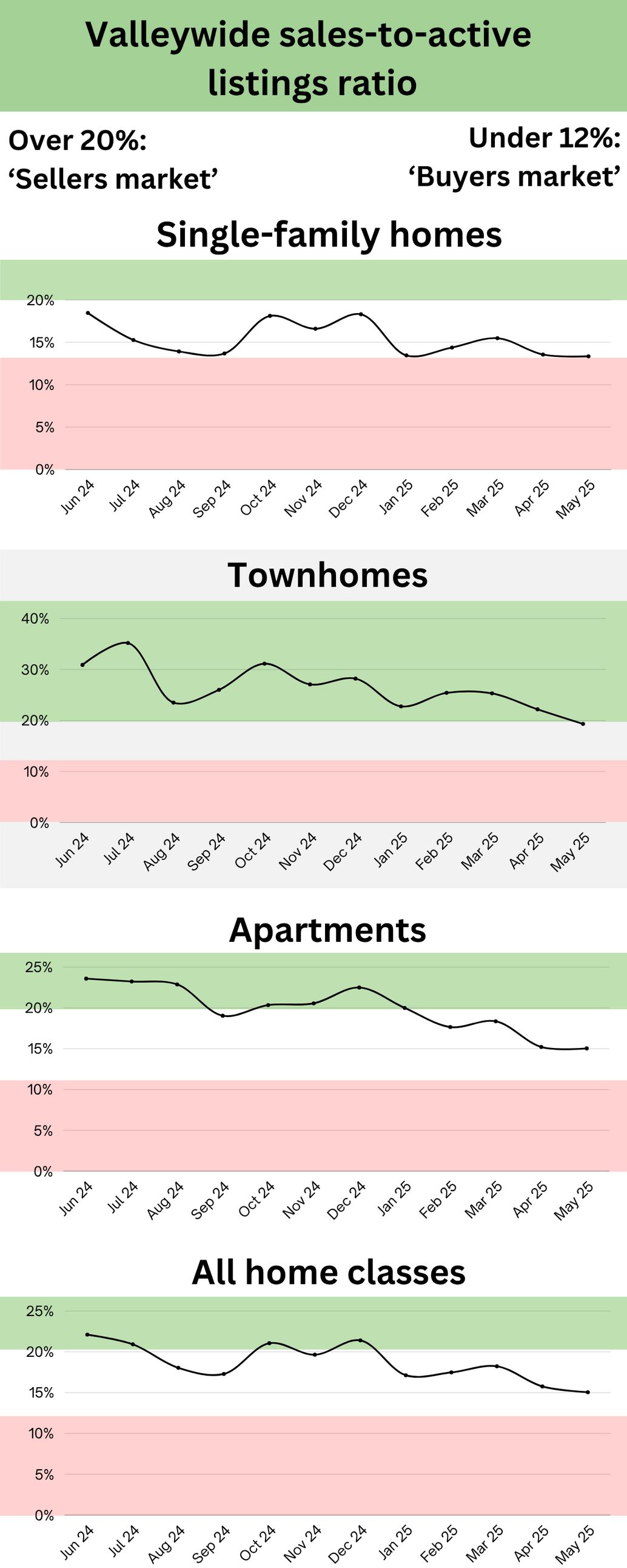

Supply and demand

How to read the charts:

Price figures can show where the housing market is at, or has been. But one can also look to supply and demand to gauge which directions home values will go in the coming months.

The charts below show each market’s ratio of sales to active listings. The measure compares how many homes are being sold to how many are listed for sale. The Fraser Valley Real Estate Board says that a sales-to-listings rate exceeding 20% is indicative of a “sellers market“—in other words, there’s considerable competition for listings and prices can be expected to rise. A rate below 12% can be considered a “buyers market,” according to the FVREB, with those looking to buy a home having plenty of selection and sellers having less leverage. That can allow would-be buyers to negotiate lower prices.

The ratio

Below our city-by-city ratio charts, we have added four new regional graphics showing the supply and demand across the region. Those charts reflect the regional nature of the housing market and help show broader trends across the valley.

Although demand for homes rebounded in Abbotsford the past month, across the region, there remains plenty of listings and few sales—especially compared to last year. The most in-demand class has been townhomes, but sales of those homes have also begun to decline.

Across the Fraser Valley, there were 4,266 homes listed for sale, compared to 3,301 for the same month last year. Just 642 homes change homes in May, a 25% drop from the same month last year.

NEW: We’ve added up all the sales and active listings between Langley and Chilliwack to better gauge region-wide supply and demand.

The eastbound discount

As The Current has previously written, home prices are generally more expensive the closer one gets to Vancouver. As home prices have increased everywhere, the dollar gap between home values in different parts of the region have widened. The figures below reflect those gaps. The gap can fluctuate from month to month because it reflects price changes in two different communities, but changes over a larger timeline can reveal shifts in the housing market—or how the figures themselves are calculated.